This website uses cookies to improve your experience on the site. By continuing to use this site, you agree to the use of cookies. To learn more about how we use cookies, please see our Cookie Policy.

This website uses cookies to improve your experience on the site. By continuing to use this site, you agree to the use of cookies. To learn more about how we use cookies, please see our Cookie Policy.

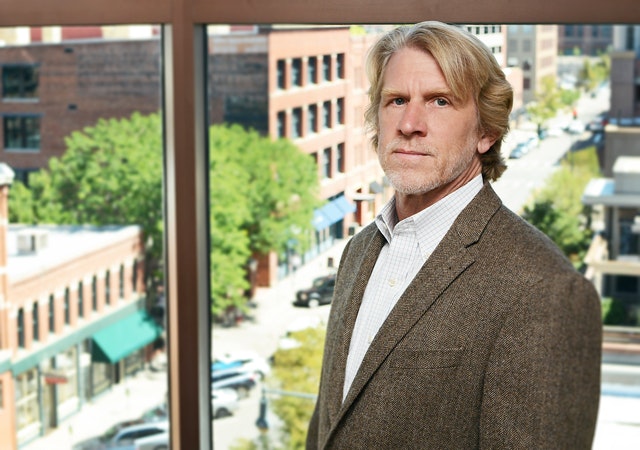

Peter Rose is an attorney at Davis Graham & Stubbs LLP. His area of expertise is international, federal, state, and local taxation of entities and individuals.

Mr. Rose holds a J.D. from the University of Colorado School of Law and an LL.M in Taxation from the University of Denver Sturm College of Law.

Mr. Rose advises clients on all facets of international, federal, state, and local taxation, including:

Mr. Rose represents taxpayers before the Internal Revenue Service, Colorado Department of Revenue, and other state and municipal tax agencies.

Prior to attending law school, Mr. Rose was the vice president of operations for Circuit Automation, a California-based manufacturer of equipment for the electronics industry, and assumed research positions with several specialty chemical companies. He holds several patents in the area of printed circuit board manufacturing equipment.

Mr. Rose acts as a volunteer guardian ad litem for children on behalf of the Rocky Mountain Children’s Law Foundation.

The 2021 edition of Chambers USA ranked Davis Graham & Stubbs LLP first in Colorado in the areas of Banking...

On January 6, 2021, the Internal Revenue Service (the “IRS”) and the Department of the Treasury released highly anticipated final...

The 2020 edition of Chambers USA ranked Davis Graham & Stubbs LLP first in Colorado in the areas of Banking...

A March 2015 United States Supreme Court case delivers a short-term victory to online retailers who do not collect sales...

Presentation Materials.

On May 30, 2014, Governor Hickenlooper signed into law HB14-1012, creating an exciting new state income tax credit to incentivize...